Volume 25, Issue 1 (Spring 2024)

jrehab 2024, 25(1): 100-115 |

Back to browse issues page

Download citation:

BibTeX | RIS | EndNote | Medlars | ProCite | Reference Manager | RefWorks

Send citation to:

BibTeX | RIS | EndNote | Medlars | ProCite | Reference Manager | RefWorks

Send citation to:

Hosseini Zare S M, Babapour J, Basakha M, Mohsenzadeh4 S M, Esfahani P, Hosseini Zare S M, et al . Evaluating the Causes of Deductions for Inpatient Bills Covered by Social Security Insurance in Rofeideh Hospital, Tehran City, Iran, in 2021. jrehab 2024; 25 (1) :100-115

URL: http://rehabilitationj.uswr.ac.ir/article-1-3294-en.html

URL: http://rehabilitationj.uswr.ac.ir/article-1-3294-en.html

Seyedeh Mahboobeh Hosseini Zare1

, Jafar Babapour2

, Jafar Babapour2

, Mehdi Basakha1

, Mehdi Basakha1

, Seyed Mahdi Mohsenzadeh43

, Seyed Mahdi Mohsenzadeh43

, Parvaneh Esfahani4

, Parvaneh Esfahani4

, Seyedeh Masoumeh Hosseini Zare5

, Seyedeh Masoumeh Hosseini Zare5

, Najmeh Ashouri2

, Najmeh Ashouri2

, Bijan Khorasani *

, Bijan Khorasani *

6

6

, Jafar Babapour2

, Jafar Babapour2

, Mehdi Basakha1

, Mehdi Basakha1

, Seyed Mahdi Mohsenzadeh43

, Seyed Mahdi Mohsenzadeh43

, Parvaneh Esfahani4

, Parvaneh Esfahani4

, Seyedeh Masoumeh Hosseini Zare5

, Seyedeh Masoumeh Hosseini Zare5

, Najmeh Ashouri2

, Najmeh Ashouri2

, Bijan Khorasani *

, Bijan Khorasani *

6

6

1- Social Determinants of Health Research Center, University of Social Welfare and Rehabilitation Sciences, Tehran, Iran.

2- Department of Clinical Sciences, School of Rehabilitation Sciences, University of Social Welfare and Rehabilitation Sciences, Tehran, Iran.

3- Deputy of Treatment and Rehabilitation, University of Social Welfare and Rehabilitation Sciences, Tehran, Iran.

4- Department of Health Care Services Management, School of Public Health, Zabol University of Medical Sciences, Tehran, Iran.

5- Sabzevar Health Care Center, Sabzevar University of Medical Sciences, Sabzevar, Iran.

6- Department of Clinical Sciences, University of Social Welfare and Rehabilitation Sciences, Tehran, Iran. , bkhorasany@hotmail.com

2- Department of Clinical Sciences, School of Rehabilitation Sciences, University of Social Welfare and Rehabilitation Sciences, Tehran, Iran.

3- Deputy of Treatment and Rehabilitation, University of Social Welfare and Rehabilitation Sciences, Tehran, Iran.

4- Department of Health Care Services Management, School of Public Health, Zabol University of Medical Sciences, Tehran, Iran.

5- Sabzevar Health Care Center, Sabzevar University of Medical Sciences, Sabzevar, Iran.

6- Department of Clinical Sciences, University of Social Welfare and Rehabilitation Sciences, Tehran, Iran. , bkhorasany@hotmail.com

Full-Text [PDF 1773 kb]

(63 Downloads)

| Abstract (HTML) (426 Views)

Full-Text: (50 Views)

Introduction

Hospitals are among the community’s largest health and medical care providers [1, 2]. They absorb significant resources in the health and treatment sectors [3]. According to a World Bank study, 50% to 80% of health resources in developing countries are consumed by hospitals [4, 5]. Therefore, one of the hospital managers’ concerns is controlling the hospital’s financial status and securing necessary resources [6, 7, 8]. Like other developing countries, Iran faces severe constraints on resources. Efficient use of resources is considered an integral part of health system management [8]. Identifying and reducing unnecessary and non-essential costs can enhance efficiency in various health system components, including hospitals [9]. One of the major financial problems in hospitals is delays in receiving claims from insurance organizations and excessive deductions labeled as insurance deductions.

With the adoption of universal insurance laws and the prevalence of health insurance, the provision and sale of services to insured individuals under the coverage of insurance organizations have become a significant part of the income sources for hospitals [10]. Thus, insurance companies constitute one of the main financial resources for hospitals [11]. Therefore, a significant portion of hospitals’ financial resources should be claimed from insurance companies [12]. After reviewing financial documents, insurance organizations deduct monthly amounts under the label of deductions from hospital claims [13]. This dissatisfaction arises because deducted amounts form part of the hospital’s income that is not deposited into its account [14]. In a situation where hospitals are financially strained, a high level of insurance deductions is unacceptable to hospital managers because it reduces the quality of services provided by hospitals and ultimately causes dissatisfaction among patients [15]. This condition underscores the importance of officials paying attention to transparency in preparing and submitting medical documents and financial resources to insurance companies [11, 16].

Numerous studies have been conducted on the causes of insurance deductions. In these studies, the most common causes include incomplete documentation, unfamiliarity with the hospital information system, incomplete registration, entering insurance codes incorrectly, exaggeration, miscalculation, and insufficient staff training [17-21]. In developed countries, companies and insurance organizations refer to deductions as improper reimbursements of medical invoice costs. A report published by the Medicare and Medicaid Services in the United States in 2018 indicated that the rate of improper payments was approximately 5.9% of the total amount paid for invoices, which amounted to $36 million out of a total of $390 billion [21]. Some studies have shown that the major cause of inpatient deductions in Iran is related to deductions in the documentation process. In contrast, in foreign studies, the most significant cause of deductions is the non-inclusion of services in insurance contracts due to the implementation of intelligent digital documentation systems and the design of appropriate payment mechanisms that eliminate many other causes [22, 23].

Financial statistics in university affairs indicate that approximately 4% to 8% of the amounts related to documents sent by university hospitals are deducted by contracted insurance organizations. A detailed examination of the causes and extent of deductions is necessary for planning to reduce deductions, increase revenues, and provide adequate resources for desirable services to patients.

Due to its nature as the only rehabilitation hospital at the national level, Rafeideh Rehabilitation Hospital faces unique challenges. The lengthy stay of patients, lack of insurance coverage for many rehabilitation services, inconsistency in basic insurance in accepting or rejecting insurance prescriptions, and the absence of clear guidelines and policies from insurance companies are among the problems that affect the economic conditions of the hospital. This study aims to determine the extent and causes of deductions in Rofeideh Rehabilitation Hospital. The results of this research can highlight the points in the hospital that lead to deductions by insurance organizations. Additionally, assessing the relationship between the documentation of administrative and preclinical staff, physicians, and nurses with insurance deductions guides hospital managers to a better and more detailed understanding of the causes of deductions. This situation, in turn, can lead to planning to reduce deducts and increase revenues. An innovation in this study is its examination of the causes of insurance deductions in Rofeideh Rehabilitation Hospital, the only rehabilitation hospital in the country with unique challenges compared to other hospitals.

Materials and Methods

This analytical descriptive study was conducted cross-sectionally to investigate the extent and causes of deductions in inpatient files covered by Iran Social Security Insurance in 2021. The study was conducted on 776 discharged inpatient files from Rafideh Rehabilitation Hospital, selected through a census approach. Rafideh Rehabilitation Hospital, the only rehabilitation hospital in the country, has been operational since 2014, providing services in both outpatient and inpatient settings.

In outpatient setting, rehabilitation units such as physiotherapy, occupational therapy, speech therapy, audiology and balance, and orthotics and prosthetics, along with clinics in physical and rehabilitation medicine, hand and peripheral nerve surgery, restorative and speech defect surgery, neurology, pediatric neurology, brain and nerve surgery, internal medicine, adult and pediatric orthopedics, infectious diseases and wounds, geriatrics, palliative and pain medicine, cardiology, palliative care, and psychology are actively providing services. In the inpatient setting, services are provided in neurology, surgery, stroke, pediatrics, and brain and spinal cord injuries.

The hospital’s operating room performs rehabilitation surgeries in orthopedics, pediatric orthopedics, hand and peripheral nerve surgery, spinal surgery, and speech rehabilitation surgeries. Patients with spinal cord injuries, brain injuries, strokes, multiple sclerosis, cerebral palsy, and other disabling sensory and motor diseases make up a significant portion of the hospital’s patient population.

In this study, the inclusion criterion was all files covered by Social Security Insurance, and the exclusion criterion was files covered by other insurances. Data were collected using reports from hospital insurance specialists through the hospital information system (HIS) software. The data included patient files, invoices, and the categorization of hospital deductions by type (visit, consultation, operating room, laboratory, radiology, paraclinical, drug, operating room, and hoteling). Deducts were identified on a monthly basis for the specified year. The causes of deductions were extracted by examining the findings obtained, consulting with Social Security Insurance representatives and hospital insurance specialists, and conducting interviews with unit managers using a checklist.

Finally, the relationship between the documentation of administrative and paraclinical staff, physicians, and nurses with insurance deductions was assessed using a questionnaire previously used in a study by Mohammadkhani et al. (2013), whose reliability had been validated [24]. The questionnaire consisted of 3 questions related to the documentation of nurses, 12 questions related to the documentation of physicians, and 16 questions related to the documentation of administrative and paraclinical staff. Responses were in the form of “yes” or “no”. Data from the questionnaire were analyzed using descriptive statistics (frequency and percentage) and the Spearman correlation coefficient. The results were presented in comparative tables. SPSS software, version 23 was used for statistical calculations.

Results

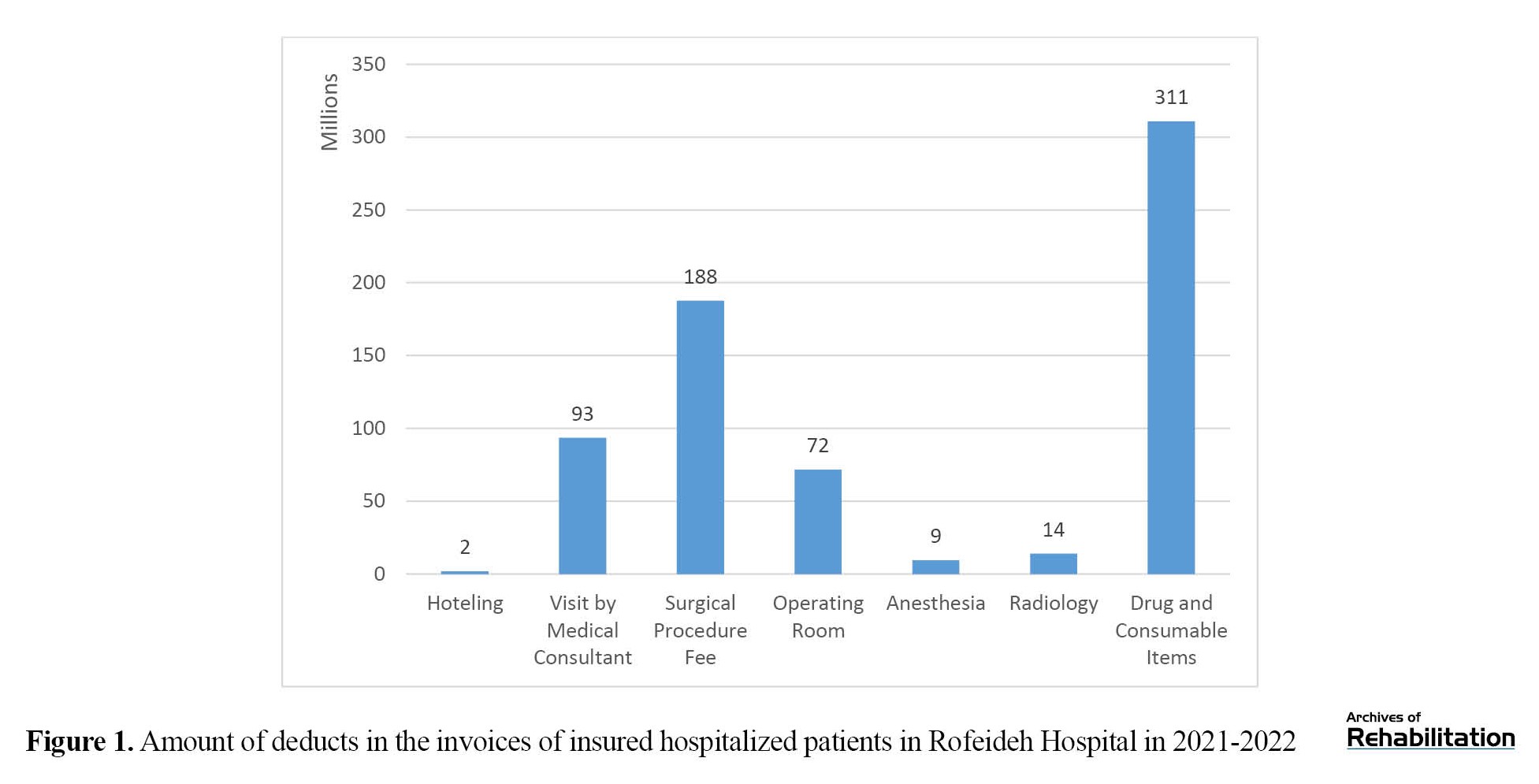

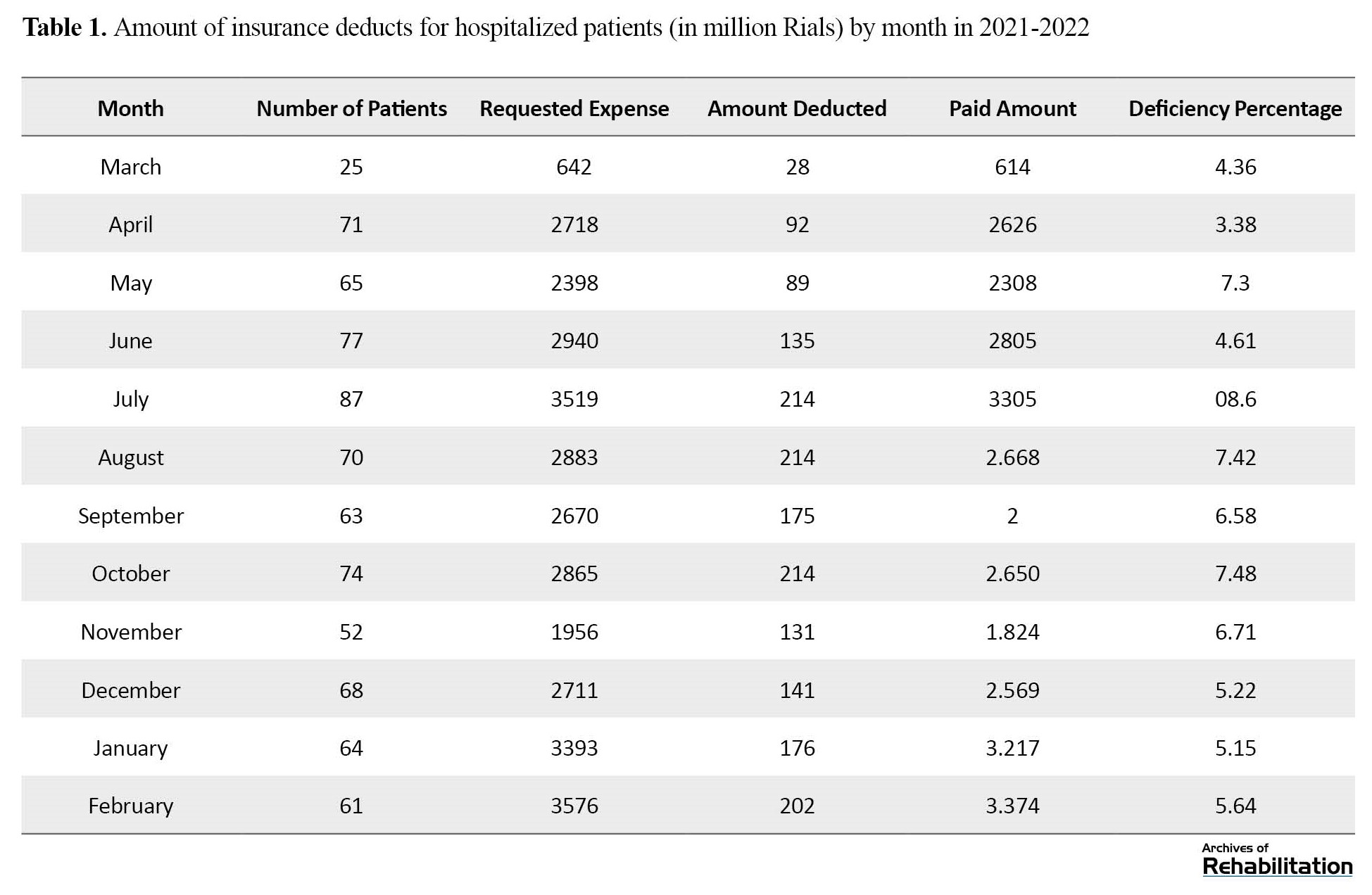

The research was conducted at Rofeideh Rehabilitation Hospital, affiliated with the University of Social Welfare and Rehabilitation Sciences. Table 1 presents the amount of insurance deductions for hospitalized patients, categorized by month, in 2021.

The examination of deficiency amounts showed that the total amount of insurance deductions related to hospitalized patients during the year was equal to 1811 million Rials, meaning that 76.3% of the cases in 2021 had deductions. The highest frequency of hospitalized prescription deducts was in October 2021 (48.7%), and the lowest was in April 2021 (38.3%).

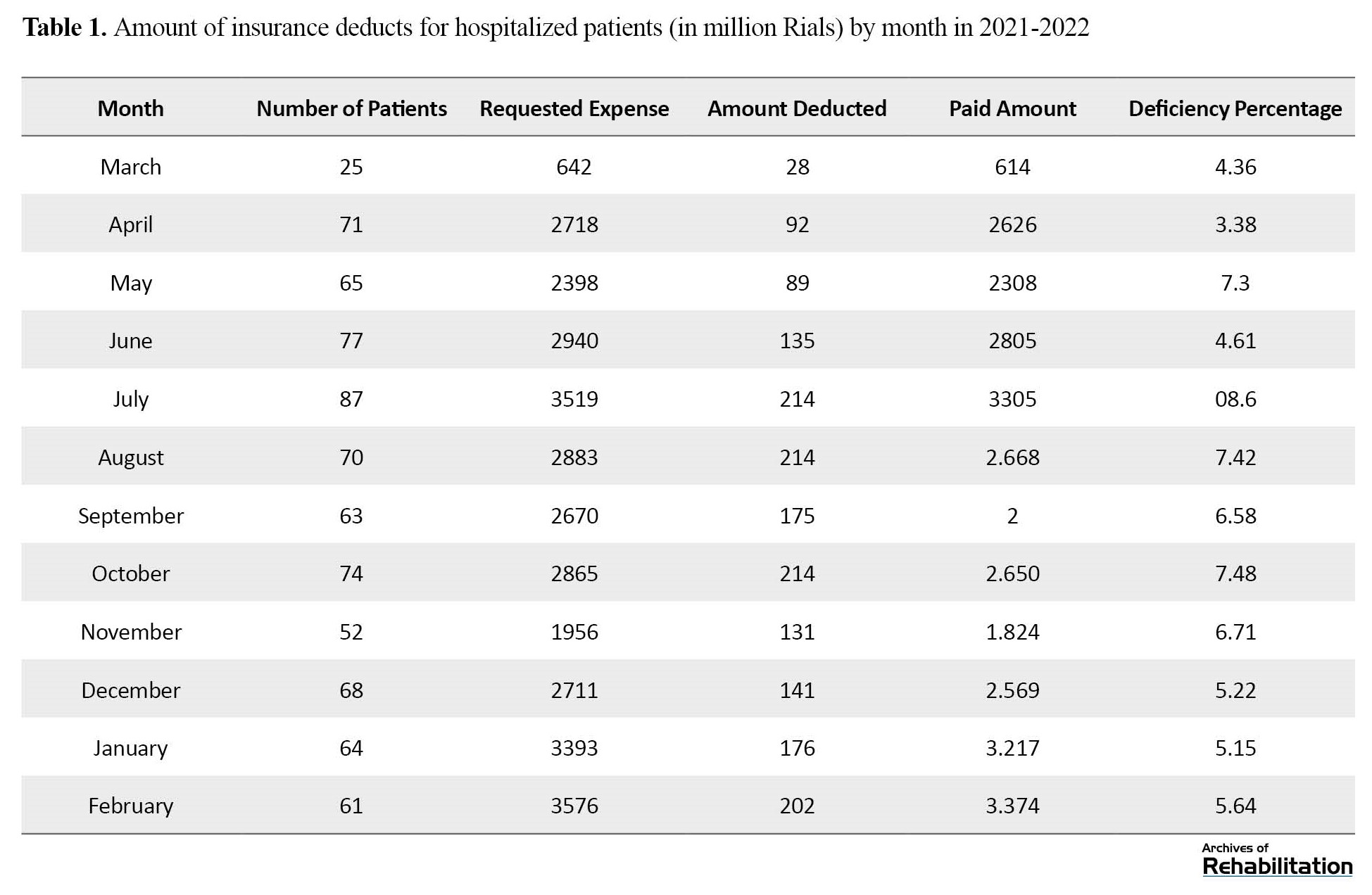

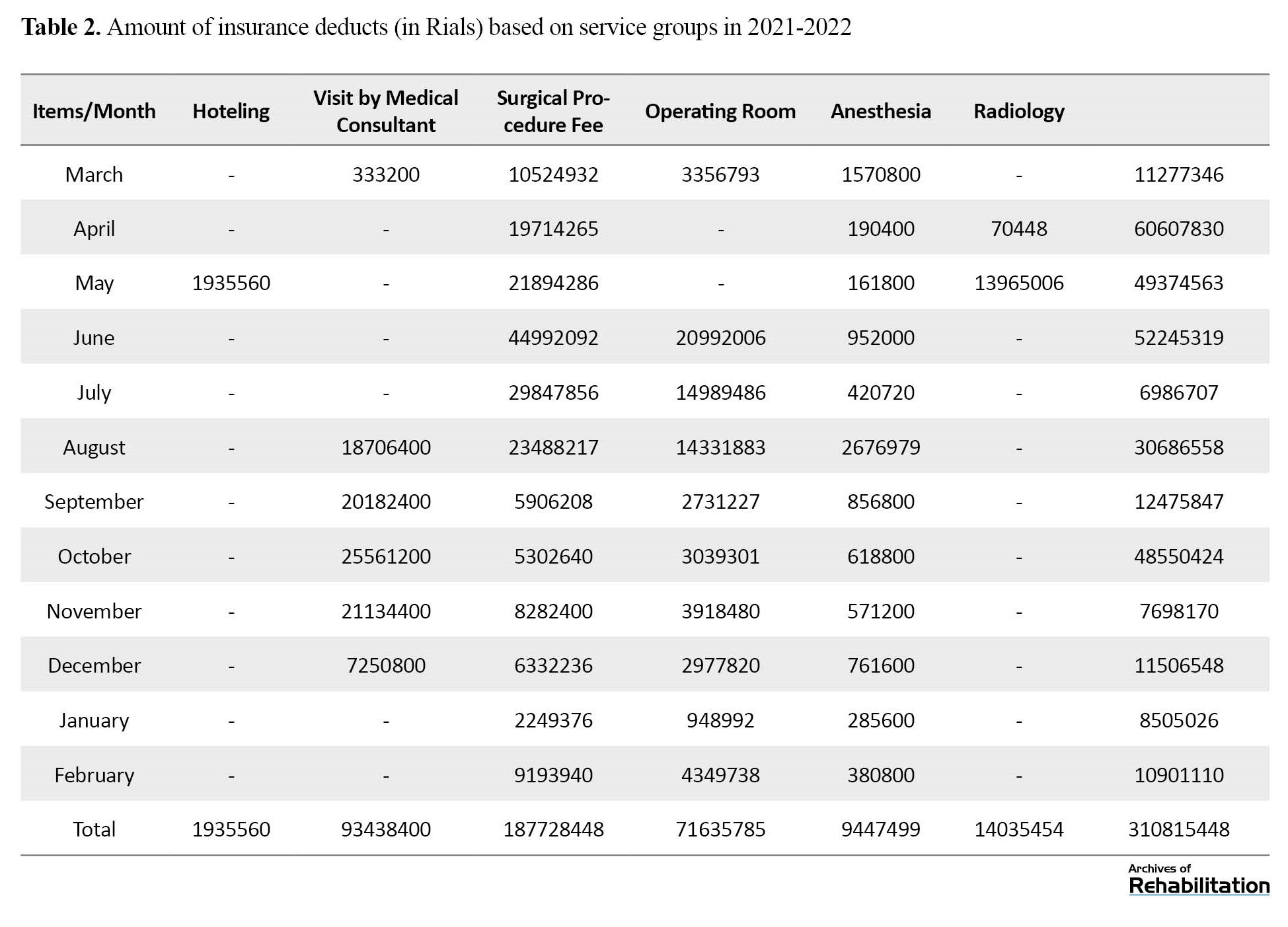

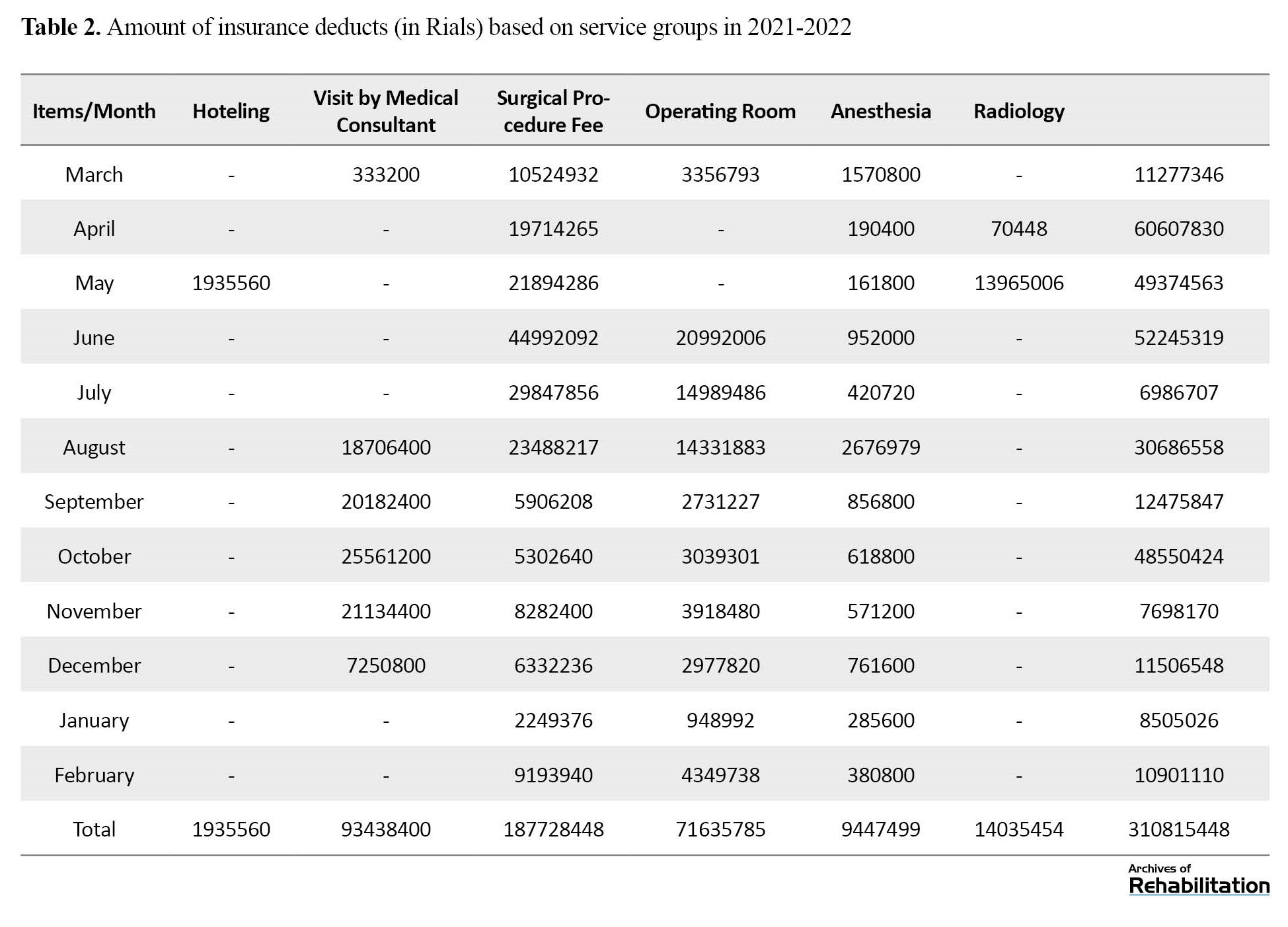

The research findings indicated that the highest deductions were related to drug and consumable items, with 310815448 Rials, and surgical procedure fees, with 187728448 Rials. The lowest deductions were related to hoteling, amounting to 1935560 Rials (Table 2).

For a better understanding of the deficiency amounts, they are also presented in Figure 1. The study results showed that the most common cause of deductions was additional requests, with an amount of 281163295 Rials, and the least common cause was documentation errors, with an amount of 88589265 Rials (Figure 2). To address the research hypotheses, the relationship between nursing, physician, administrative, and paraclinical staff documentation and the increase in deductions was tested to determine whether there is a significant relationship. The results showed a significant correlation between nursing and physician documentation and an increase in insurance deducts (P<0.001) (Table 3).

Discussion

Given the insurance laws, there are often disputes in the provision of services and, consequently, in the payment and receipt of insurance claims between insurance companies and hospitals. These disputes are exacerbated due to the nature of rehabilitation services provided by Rofeideh Hospital and the fact that, according to the relative value book of health services, many rehabilitation services are not covered by insurance. Additionally, the prolonged hospitalization of patients poses a constant challenge between these hospitals and insurance companies. Iran Health Insurance Organization has recently taken measures to include some inpatient rehabilitation services under coverage. They have defined service packages for each illness, covering them under their insurance.

This study examined insurance invoices from Social Security Organization in the inpatient rehabilitation section of Rofeideh Hospital. After identifying the reasons for deductions, their correlation with the documentation by the staff was critically analyzed. The study revealed that the highest amount of deductions in Social Security insurance invoices was related to drug and consumable expenses and surgical fees. The leading cause was identified as excessive requests and incorrect coding. The study conducted by Moalemi in 2012 compared the causes of deductions in insurance-covered inpatients’ files between two hospitals, Bahonar and Arjmand, in Kerman City, Iran. Similar to our findings, the study showed that most deductions were related to drug expenses, with the main cause being excessive requests [25]. A study by Safdari et al. on 15 hospitals affiliated with Tehran University of Medical Sciences also indicated that drug and consumable expenses and surgical fees were the most significant factors leading to deductions. The study identified shortcomings in the overall surgery description, patient registration, admission date, and procedure [14]. Results from research by Ariankhesal et al. in 2017 indicated that consumables and surgical fees had the highest deducts in inpatient files, with errors in calculations, lack of hospital supervision, and issues related to document dates and times being significant reasons [7].

The study by Mousa Zadeh et al. on deductions in the inpatient files covered by the Iran Health Insurance Organization showed that the highest amount of deductions was related to surgical fees, and the main cause was excessive requests [26]. Rezvanjou et al., in their investigation of deductions in the invoices of the Social Security Organization and medical services in two hospitals in Tabriz City, Iran, also identified surgical service fees as the most significant source of deductions [27].

In their study on teaching hospitals, Maleki et al. identified the overpricing of medications as one of the major causes of deducts in teaching hospitals [1]. The results of investigations into prescription deductions at Al-Zahra Hospital did not align with the present study’s findings, as the primary causes of prescription errors were identified as having an unclear or tampered date, past/future date issues, or lack of date [28]. This discrepancy might be attributed to the educational nature of Al-Zahra Hospital, where students and interns carry out documentation, and insufficient training on their part leads to documentation lapses.

The nature of rehabilitation at Rofeideh Hospital and the lack of recognition of the hospital’s activities, even by the healthcare system, complicate the challenges in reimbursement from insurance. One of the significant problems is the extended duration of patient hospitalization, which can last up to 63 days. Social Security Insurance does not cover services provided after 21 days of patient hospitalization, which is a major reason for excessive requests in the drug and consumable section. Another major issue in insurance deductions is related to surgical fees. Precise adherence to guidelines and regulations set by the Social Security Insurance Organization is crucial for the hospital’s financial claims.

The findings of our study indicate a direct relationship between the documentation by physicians and nurses and an increase in insurance deductions. Fathi demonstrated that defective documentation by physicians and nurses is one of the main causes of deducts [29]. However, Davis attributed responsibility for determining the role of complete documentation in hospital expense payments to medical document officials [30]. Ghaed et al.’s research showed that a significant portion of deducts was due to the lack of sufficient skills in documenters, mistakes made by the healthcare team in documentation, and non-approval by documenters, especially physicians [8]. Imani et al. also demonstrated that physician documentation is one of the causes of deducts in Tabriz hospitals, with the lack of familiarity with declared tariffs and lack of coding skills being the reasons [21]. Tavakoli et al. found that the treatment team’s incomplete documentation of patient records was one of the most important reasons for deductions [28]. Ariankhesal et al.’s study revealed that physicians and nurses play the most significant role in creating deductions [7].

The surgical operation report form is the basis for billing surgical fees by insurance organizations, and the responsibility for recording data lies with operating room nurses and ward secretaries. In contrast, the surgeon’s responsibility is to register the operation description completely. It can be said that the main reason for deductions in this area is documentation inadequacy. In a study by Mousa Zadeh et al., most factors contributing to deductions were related to inaccuracies in service calculation and incomplete documentation [26]. Since human error exists in all fields, using electronic systems in this area is very beneficial. Howard et al. have found the use of computer systems and their effective role in improving documentation quality and reducing medical errors to be significant. They believe that these systems can inform users about file deductions through alerts, leading to a reduction in insurance deductions [31].

The most significant limitation of the present study was the lack of recording reasons for some deductions in patients’ records or assigning codes to records with insurance deductions by social insurance experts, which was unknown to hospital insurance experts.

Conclusion

Accurate documentation in medical records significantly impacts the amount reimbursed by insurance organizations and prevents insurance deductions. Considering the significant relationship between documentation by physicians and nurses and the increase in insurance deductions, it is recommended that training courses be conducted for nursing and medical staff. One of the reasons for assigning the code “excessive request” was related to the prolonged stay of patients. In this regard, it is suggested that hospital officials hold sessions with managers of the Social Security Organization to justify the provision of services to rehabilitation patients and the reasons for the prolonged stay of such patients. Since the records are registered in the HIS (Hospital Information System) and the Ministry of Health has initiated a project for electronic registration of inpatient documents by health insurance, it is recommended that the Social Security Organization provide the necessary infrastructure for the start of this project and take the necessary steps for electronic registration of insurance deducts. As many rehabilitation services are not covered by insurance, and payments in this area are generally made out of pocket, the Social Security Organization should define service packages similar to the Iran Health Insurance Organization, covering all services, whether rehabilitation, diagnostic, or therapeutic, under insurance coverage. Insurance experts from the Social Security Organization indicate the causes of deducts by registering numeric codes on patient records, which are unknown to hospital insurance experts. To address this issue, it is recommended that the Social Security Organization take necessary steps to educate its experts on identifying these codes.

Ethical Considerations

Compliance with ethical guidelines

This study was approved by the Ethics Committee of the University of Social Welfare and Rehabilitation Sciences (Code: IR.USWR.REC.1399.171).

Funding

This research was supported by the research project, Funded by the University of Social Welfare and Rehabilitation Sciences.

Authors' contributions

Study design, conceptualization: Seyedeh Mahboubeh Hosseini Zare; Methodology, validation, and data analysis: Mehdi Basakha and Parvaneh Esfahani; Investigation and analysis: Jafar Babapour and Seyed Mehdi Mohsenzadeh; Project supervision and management: Bijan Khorasani; Writing: Seyedeh Mahboubeh Hosseini Zare; Editing and finalization: Seyedeh Masoumeh Hosseini Zare; Research and resources: Najmeh Ashouri.

Conflict of interest

The authors declared no conflict of interest.

Acknowledgments

The authors express their gratitude to the staff and officials of Rofeideh Rehabilitation Hospital for their assistance in this research.

References

Hospitals are among the community’s largest health and medical care providers [1, 2]. They absorb significant resources in the health and treatment sectors [3]. According to a World Bank study, 50% to 80% of health resources in developing countries are consumed by hospitals [4, 5]. Therefore, one of the hospital managers’ concerns is controlling the hospital’s financial status and securing necessary resources [6, 7, 8]. Like other developing countries, Iran faces severe constraints on resources. Efficient use of resources is considered an integral part of health system management [8]. Identifying and reducing unnecessary and non-essential costs can enhance efficiency in various health system components, including hospitals [9]. One of the major financial problems in hospitals is delays in receiving claims from insurance organizations and excessive deductions labeled as insurance deductions.

With the adoption of universal insurance laws and the prevalence of health insurance, the provision and sale of services to insured individuals under the coverage of insurance organizations have become a significant part of the income sources for hospitals [10]. Thus, insurance companies constitute one of the main financial resources for hospitals [11]. Therefore, a significant portion of hospitals’ financial resources should be claimed from insurance companies [12]. After reviewing financial documents, insurance organizations deduct monthly amounts under the label of deductions from hospital claims [13]. This dissatisfaction arises because deducted amounts form part of the hospital’s income that is not deposited into its account [14]. In a situation where hospitals are financially strained, a high level of insurance deductions is unacceptable to hospital managers because it reduces the quality of services provided by hospitals and ultimately causes dissatisfaction among patients [15]. This condition underscores the importance of officials paying attention to transparency in preparing and submitting medical documents and financial resources to insurance companies [11, 16].

Numerous studies have been conducted on the causes of insurance deductions. In these studies, the most common causes include incomplete documentation, unfamiliarity with the hospital information system, incomplete registration, entering insurance codes incorrectly, exaggeration, miscalculation, and insufficient staff training [17-21]. In developed countries, companies and insurance organizations refer to deductions as improper reimbursements of medical invoice costs. A report published by the Medicare and Medicaid Services in the United States in 2018 indicated that the rate of improper payments was approximately 5.9% of the total amount paid for invoices, which amounted to $36 million out of a total of $390 billion [21]. Some studies have shown that the major cause of inpatient deductions in Iran is related to deductions in the documentation process. In contrast, in foreign studies, the most significant cause of deductions is the non-inclusion of services in insurance contracts due to the implementation of intelligent digital documentation systems and the design of appropriate payment mechanisms that eliminate many other causes [22, 23].

Financial statistics in university affairs indicate that approximately 4% to 8% of the amounts related to documents sent by university hospitals are deducted by contracted insurance organizations. A detailed examination of the causes and extent of deductions is necessary for planning to reduce deductions, increase revenues, and provide adequate resources for desirable services to patients.

Due to its nature as the only rehabilitation hospital at the national level, Rafeideh Rehabilitation Hospital faces unique challenges. The lengthy stay of patients, lack of insurance coverage for many rehabilitation services, inconsistency in basic insurance in accepting or rejecting insurance prescriptions, and the absence of clear guidelines and policies from insurance companies are among the problems that affect the economic conditions of the hospital. This study aims to determine the extent and causes of deductions in Rofeideh Rehabilitation Hospital. The results of this research can highlight the points in the hospital that lead to deductions by insurance organizations. Additionally, assessing the relationship between the documentation of administrative and preclinical staff, physicians, and nurses with insurance deductions guides hospital managers to a better and more detailed understanding of the causes of deductions. This situation, in turn, can lead to planning to reduce deducts and increase revenues. An innovation in this study is its examination of the causes of insurance deductions in Rofeideh Rehabilitation Hospital, the only rehabilitation hospital in the country with unique challenges compared to other hospitals.

Materials and Methods

This analytical descriptive study was conducted cross-sectionally to investigate the extent and causes of deductions in inpatient files covered by Iran Social Security Insurance in 2021. The study was conducted on 776 discharged inpatient files from Rafideh Rehabilitation Hospital, selected through a census approach. Rafideh Rehabilitation Hospital, the only rehabilitation hospital in the country, has been operational since 2014, providing services in both outpatient and inpatient settings.

In outpatient setting, rehabilitation units such as physiotherapy, occupational therapy, speech therapy, audiology and balance, and orthotics and prosthetics, along with clinics in physical and rehabilitation medicine, hand and peripheral nerve surgery, restorative and speech defect surgery, neurology, pediatric neurology, brain and nerve surgery, internal medicine, adult and pediatric orthopedics, infectious diseases and wounds, geriatrics, palliative and pain medicine, cardiology, palliative care, and psychology are actively providing services. In the inpatient setting, services are provided in neurology, surgery, stroke, pediatrics, and brain and spinal cord injuries.

The hospital’s operating room performs rehabilitation surgeries in orthopedics, pediatric orthopedics, hand and peripheral nerve surgery, spinal surgery, and speech rehabilitation surgeries. Patients with spinal cord injuries, brain injuries, strokes, multiple sclerosis, cerebral palsy, and other disabling sensory and motor diseases make up a significant portion of the hospital’s patient population.

In this study, the inclusion criterion was all files covered by Social Security Insurance, and the exclusion criterion was files covered by other insurances. Data were collected using reports from hospital insurance specialists through the hospital information system (HIS) software. The data included patient files, invoices, and the categorization of hospital deductions by type (visit, consultation, operating room, laboratory, radiology, paraclinical, drug, operating room, and hoteling). Deducts were identified on a monthly basis for the specified year. The causes of deductions were extracted by examining the findings obtained, consulting with Social Security Insurance representatives and hospital insurance specialists, and conducting interviews with unit managers using a checklist.

Finally, the relationship between the documentation of administrative and paraclinical staff, physicians, and nurses with insurance deductions was assessed using a questionnaire previously used in a study by Mohammadkhani et al. (2013), whose reliability had been validated [24]. The questionnaire consisted of 3 questions related to the documentation of nurses, 12 questions related to the documentation of physicians, and 16 questions related to the documentation of administrative and paraclinical staff. Responses were in the form of “yes” or “no”. Data from the questionnaire were analyzed using descriptive statistics (frequency and percentage) and the Spearman correlation coefficient. The results were presented in comparative tables. SPSS software, version 23 was used for statistical calculations.

Results

The research was conducted at Rofeideh Rehabilitation Hospital, affiliated with the University of Social Welfare and Rehabilitation Sciences. Table 1 presents the amount of insurance deductions for hospitalized patients, categorized by month, in 2021.

The examination of deficiency amounts showed that the total amount of insurance deductions related to hospitalized patients during the year was equal to 1811 million Rials, meaning that 76.3% of the cases in 2021 had deductions. The highest frequency of hospitalized prescription deducts was in October 2021 (48.7%), and the lowest was in April 2021 (38.3%).

The research findings indicated that the highest deductions were related to drug and consumable items, with 310815448 Rials, and surgical procedure fees, with 187728448 Rials. The lowest deductions were related to hoteling, amounting to 1935560 Rials (Table 2).

For a better understanding of the deficiency amounts, they are also presented in Figure 1. The study results showed that the most common cause of deductions was additional requests, with an amount of 281163295 Rials, and the least common cause was documentation errors, with an amount of 88589265 Rials (Figure 2). To address the research hypotheses, the relationship between nursing, physician, administrative, and paraclinical staff documentation and the increase in deductions was tested to determine whether there is a significant relationship. The results showed a significant correlation between nursing and physician documentation and an increase in insurance deducts (P<0.001) (Table 3).

Discussion

Given the insurance laws, there are often disputes in the provision of services and, consequently, in the payment and receipt of insurance claims between insurance companies and hospitals. These disputes are exacerbated due to the nature of rehabilitation services provided by Rofeideh Hospital and the fact that, according to the relative value book of health services, many rehabilitation services are not covered by insurance. Additionally, the prolonged hospitalization of patients poses a constant challenge between these hospitals and insurance companies. Iran Health Insurance Organization has recently taken measures to include some inpatient rehabilitation services under coverage. They have defined service packages for each illness, covering them under their insurance.

This study examined insurance invoices from Social Security Organization in the inpatient rehabilitation section of Rofeideh Hospital. After identifying the reasons for deductions, their correlation with the documentation by the staff was critically analyzed. The study revealed that the highest amount of deductions in Social Security insurance invoices was related to drug and consumable expenses and surgical fees. The leading cause was identified as excessive requests and incorrect coding. The study conducted by Moalemi in 2012 compared the causes of deductions in insurance-covered inpatients’ files between two hospitals, Bahonar and Arjmand, in Kerman City, Iran. Similar to our findings, the study showed that most deductions were related to drug expenses, with the main cause being excessive requests [25]. A study by Safdari et al. on 15 hospitals affiliated with Tehran University of Medical Sciences also indicated that drug and consumable expenses and surgical fees were the most significant factors leading to deductions. The study identified shortcomings in the overall surgery description, patient registration, admission date, and procedure [14]. Results from research by Ariankhesal et al. in 2017 indicated that consumables and surgical fees had the highest deducts in inpatient files, with errors in calculations, lack of hospital supervision, and issues related to document dates and times being significant reasons [7].

The study by Mousa Zadeh et al. on deductions in the inpatient files covered by the Iran Health Insurance Organization showed that the highest amount of deductions was related to surgical fees, and the main cause was excessive requests [26]. Rezvanjou et al., in their investigation of deductions in the invoices of the Social Security Organization and medical services in two hospitals in Tabriz City, Iran, also identified surgical service fees as the most significant source of deductions [27].

In their study on teaching hospitals, Maleki et al. identified the overpricing of medications as one of the major causes of deducts in teaching hospitals [1]. The results of investigations into prescription deductions at Al-Zahra Hospital did not align with the present study’s findings, as the primary causes of prescription errors were identified as having an unclear or tampered date, past/future date issues, or lack of date [28]. This discrepancy might be attributed to the educational nature of Al-Zahra Hospital, where students and interns carry out documentation, and insufficient training on their part leads to documentation lapses.

The nature of rehabilitation at Rofeideh Hospital and the lack of recognition of the hospital’s activities, even by the healthcare system, complicate the challenges in reimbursement from insurance. One of the significant problems is the extended duration of patient hospitalization, which can last up to 63 days. Social Security Insurance does not cover services provided after 21 days of patient hospitalization, which is a major reason for excessive requests in the drug and consumable section. Another major issue in insurance deductions is related to surgical fees. Precise adherence to guidelines and regulations set by the Social Security Insurance Organization is crucial for the hospital’s financial claims.

The findings of our study indicate a direct relationship between the documentation by physicians and nurses and an increase in insurance deductions. Fathi demonstrated that defective documentation by physicians and nurses is one of the main causes of deducts [29]. However, Davis attributed responsibility for determining the role of complete documentation in hospital expense payments to medical document officials [30]. Ghaed et al.’s research showed that a significant portion of deducts was due to the lack of sufficient skills in documenters, mistakes made by the healthcare team in documentation, and non-approval by documenters, especially physicians [8]. Imani et al. also demonstrated that physician documentation is one of the causes of deducts in Tabriz hospitals, with the lack of familiarity with declared tariffs and lack of coding skills being the reasons [21]. Tavakoli et al. found that the treatment team’s incomplete documentation of patient records was one of the most important reasons for deductions [28]. Ariankhesal et al.’s study revealed that physicians and nurses play the most significant role in creating deductions [7].

The surgical operation report form is the basis for billing surgical fees by insurance organizations, and the responsibility for recording data lies with operating room nurses and ward secretaries. In contrast, the surgeon’s responsibility is to register the operation description completely. It can be said that the main reason for deductions in this area is documentation inadequacy. In a study by Mousa Zadeh et al., most factors contributing to deductions were related to inaccuracies in service calculation and incomplete documentation [26]. Since human error exists in all fields, using electronic systems in this area is very beneficial. Howard et al. have found the use of computer systems and their effective role in improving documentation quality and reducing medical errors to be significant. They believe that these systems can inform users about file deductions through alerts, leading to a reduction in insurance deductions [31].

The most significant limitation of the present study was the lack of recording reasons for some deductions in patients’ records or assigning codes to records with insurance deductions by social insurance experts, which was unknown to hospital insurance experts.

Conclusion

Accurate documentation in medical records significantly impacts the amount reimbursed by insurance organizations and prevents insurance deductions. Considering the significant relationship between documentation by physicians and nurses and the increase in insurance deductions, it is recommended that training courses be conducted for nursing and medical staff. One of the reasons for assigning the code “excessive request” was related to the prolonged stay of patients. In this regard, it is suggested that hospital officials hold sessions with managers of the Social Security Organization to justify the provision of services to rehabilitation patients and the reasons for the prolonged stay of such patients. Since the records are registered in the HIS (Hospital Information System) and the Ministry of Health has initiated a project for electronic registration of inpatient documents by health insurance, it is recommended that the Social Security Organization provide the necessary infrastructure for the start of this project and take the necessary steps for electronic registration of insurance deducts. As many rehabilitation services are not covered by insurance, and payments in this area are generally made out of pocket, the Social Security Organization should define service packages similar to the Iran Health Insurance Organization, covering all services, whether rehabilitation, diagnostic, or therapeutic, under insurance coverage. Insurance experts from the Social Security Organization indicate the causes of deducts by registering numeric codes on patient records, which are unknown to hospital insurance experts. To address this issue, it is recommended that the Social Security Organization take necessary steps to educate its experts on identifying these codes.

Ethical Considerations

Compliance with ethical guidelines

This study was approved by the Ethics Committee of the University of Social Welfare and Rehabilitation Sciences (Code: IR.USWR.REC.1399.171).

Funding

This research was supported by the research project, Funded by the University of Social Welfare and Rehabilitation Sciences.

Authors' contributions

Study design, conceptualization: Seyedeh Mahboubeh Hosseini Zare; Methodology, validation, and data analysis: Mehdi Basakha and Parvaneh Esfahani; Investigation and analysis: Jafar Babapour and Seyed Mehdi Mohsenzadeh; Project supervision and management: Bijan Khorasani; Writing: Seyedeh Mahboubeh Hosseini Zare; Editing and finalization: Seyedeh Masoumeh Hosseini Zare; Research and resources: Najmeh Ashouri.

Conflict of interest

The authors declared no conflict of interest.

Acknowledgments

The authors express their gratitude to the staff and officials of Rofeideh Rehabilitation Hospital for their assistance in this research.

References

- Maleki M, Bolghadr S, Aghaeihashjin A. [Determining the amount and causes of insurance deficits in selected Teaching and non-Teaching hospitals affiliated to Iran University of Medical Sciences (Persian)]. Journal of Health Administration. 2021; 23(4):80-91. [DOI:10.29252/jha.23.4.80]

- Zhu Y, Zhao Y, Dou L, Guo R, Gu X, Gao R, et al. The hospital management practices in Chinese county hospitals and its association with quality of care, efficiency and finance. BMC Health Services Research. 2021; 21(1):449. [DOI:10.1186/s12913-021-06472-7] [PMID] [PMCID]

- Özgen Narcı H, Ozcan YA, Şahin İ, Tarcan M, Narcı M. An examination of competition and efficiency for hospital industry in Turkey. Health Care Management Science. 2015; 18(4):407-18. [DOI:10.1007/s10729-014-9315-x] [PMID]

- Yang CH, Lee KC, Li SE. A mixed activity-based costing and resource constraint optimal decision model for IoT-oriented intelligent building management system portfolios. Sustainable Cities and Society. 2020; 60:102142. [DOI:10.1016/j.scs.2020.102142]

- Sheperd D, Hodgkin D, Anthony Y. Analysis of hospital costs: A manual for managers. Geneva: World Health Organization; 2003. [Link]

- Nanakar R. Reviews on the role of economic management accounting system in Kashan University of Medical Sciences. Journal of Homaye Salamat. 2007; 5:30-5. [Link]

- Ariankhesal A, Kalantari H, Raeissi P, Sadeghi N. [Insurance deductions of hospitals in Iran: Systematic review of causes and solutions to reduce deductions (Persian)]. Hakim. 2019; 22(1):1-13. [Link]

- GhaedChukamei Z, Golshanei M, Delavari S, Bagheri Tula Rud P. [Exploring the rate and causes of the deduction by health insurance and social security insurance in an educational hospital in Rasht (Persian)]. Journal of Guilan University of Medical Sciences. 2019; 28(111):45-55. [Link]

- Mohammadi A, Azizi AA, Cheraghbaigi R, Mohammadi R, Zarei J, Valinejadi A. [Analyzing the deductions applied by the medical services and social security organization insurance toward receivable bills bye university hospitals of Khorramabad (Persian)]. Health Information Management. 2013;10(2):172-80. [Link]

- Marnani AB, Teymourzadeh E, Bahadori M, Ravangard R, Saeid Pour J. Challenges of a large health insurance organization in Iran: A qualitative study. International Journal of Collaborative Research on Internal Medicine & Public Health. 2012; 4(6):1050-62. [Link]

- Hosseini-Shokouh SM, Matin HM, Yaghoubi M, Sepandi M, Ameryoun A, Hosseini-Shokouh SJ. [Amount and causes of insurance deductions for the armed forces medical services organization in a military hospital in Tehran, Iran (Persian)]. Journal of Military Medicine. 2018; 20(4):402-11. [Link]

- Ökem ZG, Çakar M. What have health care reforms achieved in Turkey? An appraisal of the "health transformation programme". Health Policy. 2015; 119(9):1153-63. [DOI:10.1016/j.healthpol.2015.06.003] [PMID]

- Najibi M, Dehghan H, Jafari A, Hoseinpour T, Rezaee R. A study of the problems between basic insurance organizations and teaching hospitals of Shiraz University of Medical Sciences as viewed by the staff of income hospitals and representative of the insurer’s organization in 2013. Health Management & Information Science. 2015; 2(3):82-8. [Link]

- Safdari R, Sharifian R, Ghazi Saeedi M, Masoori N, Azad Manjir Z. [The amount and causes deductions of bills in Tehran University of Medical Sciences Hospitals (Persian)]. Payavard Salamat. 2011; 5(2):61-70. [Link]

- Asbu E, Walker O, Kirigia J, Zawaira F, Magombo F, Zimpita P, et al. Assessing the efficiency of hospitals in Malawi: An application of the Pabón Lasso technique. African Health Monitor Journal. 2012; 14(special issue):25-33. [Link]

- Roos AF, Schut FT. Spillover effects of supplementary on basic health insurance: Evidence from the Netherlands. The European Journal of Health Economics. 2012; 13(1):51-62. [DOI:10.1007/s10198-010-0279-6] [PMID] [PMCID]

- Mosadeghrad AM, Esfahani P, Nikafshar M. [Hospitals’ efficiency in Iran: A systematic review and meta-analysis of two decades of research (Persian)]. Payavard Salamat. 2017; 11(3):318-31. [Link]

- Mosadeghrad AM, Mirzaee N, Afshari M, Darrudi A. [The impact of health transformation plan on health services fees: Brief report (Persian)]. Tehran University of Medical Journal. 2018; 76(4):277-82. [Link]

- Mosadeghrad AM, Esfahani P, Afshari M. [Strategies to improve hospital efficiency in Iran: A scoping review (Persian)]. Payesh. 2019; 18(1):7-21. [Link]

- Mahdiyan S, Dehghani A, Tafti AD, Pakdaman M, Askari R. Hospitals’ efficiency in Iran: A systematic review and meta-analysis. Journal of Education and Health Promotion. 2019; 8(1):126. [DOI:10.4103/jehp.jehp_393_18]

- Imani A, Doshmangir L, Mousarrezaei MT. [The analysis of the causes of hospitalized patientsmedical records deductions (Persian)]. Depiction of Health. 2020; 11(2):172-89. [DOI:10.34172/doh.2020.17]

- Saravi BM, Asgari Z, Siamian H, Farahabadi EB, Gorji AH, Motamed N, et al. Documentation of medical records in hospitals of mazandaran university of medical sciences in 2014: A quantitative study. Acta Informatica Medica. 2016; 24(3):202-6. [DOI:10.5455/aim.2016.24.202-206] [PMID] [PMCID]

- Klein-Hitpaß U, Scheller-Kreinsen D. Policy trends and reforms in the German DRG-based hospital payment system. Health Policy. 2015; 119(3):252-7. [DOI:10.1016/j.healthpol.2015.01.006] [PMID]

- Mohammad Khani M. [Evaluation of patient’s bill and their deductions covered by health insurance (case study of Medical Sciences University of Tehran hospitals)(Persian)] [MSc thesis].Tehran: Payam Noor university; 2011

- Moalemi S, Shamsabadi AR, Meshkani Z, Alikiani A, Kazemi Karyani A. Survey and comparison on the causes of deduction in admitted social insurance: Bahonar and Arjmand hospital in Kerman. Association of Health Information Management of Iran. 2014; 8(1):17-23.

- Mousa Zadeh Y, Soleymanzadeh M, Nosratnejad S. [Exploring the rate and causes of inpatient records deductions covered by Iran health insurance: The case of a public hospital in Tabriz (Persian)]. Depiction of Health. 2017; 8(2):119-25. [Link]

- Rezvanjou H, Sokhanvar M, Doshmangir L. [Exploring the rate and causes of deductions imposed on social security and health insurances bills related to inpatients in two hospitals affiliated with Tabriz University of Medical Sciences (Persian)]. Depiction of Health. 2017; 7(4):7-13. [Link]

- Tavakoli N, Saghaeian-nejad S, Rezayatmand MR. Documentation of medical records and insurance deductions imposed by health services Insurance. Health Information Management. 2006; 3(2):53-61. [Link]

- Fatehi AA. [The survey on causes and rates of deductions applied by Tamin-e-Ejtemaei insurance company on patients bills at hospitals of Firozabadi and Sina (Percian)] [Msc thesis]. Tehran: Iran University of Medical Sciences; 2008. [Link]

- Davis NA, LaCour M. Health information technology-E-Book. Amsterdam: Elsevier Health Sciences; 2014. [Link]

- Howard WR. Respiratory care billing using a personal digital assistant. Respiratory Care. 2004; 49(11):1339-48. [PMID]

Type of Study: Original |

Received: 6/05/2023 | Accepted: 2/10/2023 | Published: 1/04/2024

Received: 6/05/2023 | Accepted: 2/10/2023 | Published: 1/04/2024

Send email to the article author

| Rights and permissions | |

|

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License. |